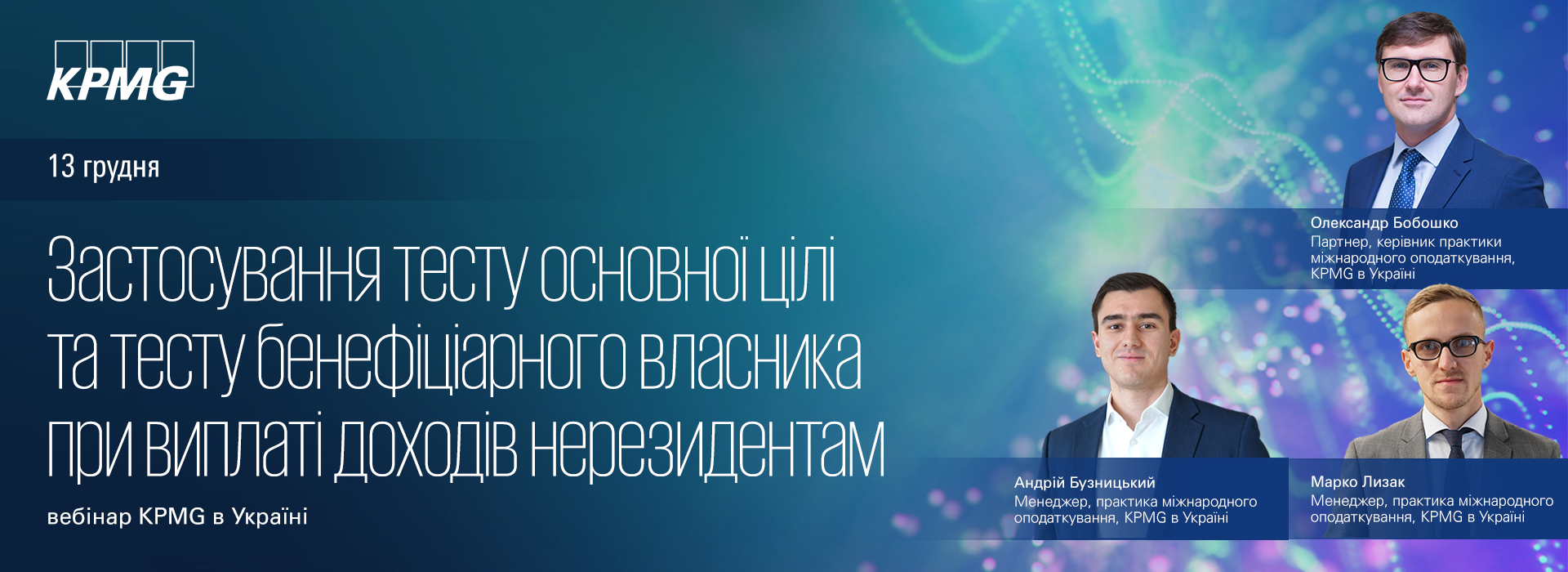

Date: 13 December

Time: 11:00 – 12:20

Format of the event: webinar

Registration: https://cutt.ly/OYevpWM

Ukraine adopted new rules in 2020 for applying reduced rates on income tax when paying passive income to non-residents. Today, if a company pays dividends, interest, or royalties to foreign companies, they must ensure that this income is actually received by the beneficial owner and passes the principal purpose test, i.e. one of the main goals of the transaction or structure must not be reducing non-resident income tax rates.

What are the criteria for determining the beneficial ownership of income and passing the principal purpose test in accordance with the Tax Code of Ukraine? What does the latest Ukrainian case law have to say about these issues? Our KPMG experts have the answers to these and many other questions, and they would be happy to share them with you in our free webinar.

We will discuss the following issues:

- Beneficial ownership: the specifics of this status according to Ukrainian law and case law

- Applying a ‘walk-through approach’ for paying passive income to non-residents who are not beneficial owners

- The principal purpose test: the specifics of applying the test in accordance with Ukrainian legislation, money laundering identification rules, and bilateral conventions on double taxation evasion

- Ukrainian and international case law for applying the principal purpose test

- Planning for change: what to think about now and what steps to take in the future to pass principal purpose and beneficial ownership tests

Speakers from KPMG:

Oleksandr Boboshko, Partner, Head of International Tax, KPMG in Ukraine. Oleksandr works in KPMG’s International Tax Practice, keeping clients up to date with all the latest changes and trends. Oleksandr’s previous experience includes work at KPMG Malta where he was responsible for advising clients on international tax structuring when establishing and operating holding companies, as well international financial and trading structures. Oleksandr has provided tax support to corporate and financial restructuring projects in more than 10 jurisdictions; including Malta, the United States, the United Kingdom, the Netherlands, Switzerland, and Italy.

Andrii Buznytskyi, Manager, International Tax, KPMG in Ukraine. Andrii advises on international tax structuring issues, in particular on the creation of holding / trading structures and structuring of investments abroad. Over the last year Andrii has implemented about 25 complex projects on restructuring of international groups with the involvement of foreign KPMG offices and external legal advisors.

Marko Lyzak, Manager, International Tax, KPMG in Ukraine. Marko has significant experience in implementing projects for companies in various sectors of the economy, providing a wide range of advisory services on various tax and legal issues, in particular the structuring of investments into and out of Ukraine, international tax structuring of holding and financial structures.

If the webinar of interest to you, please register no later than 12 December 2021. Participation in this webinar is free. Applications from consulting, legal, and audit companies will not be accepted. The organisers reserve the right to refuse registration to the event for participants whose companies cannot be identified.

KPMG in Ukraine would be happy to find answers to all your business-related questions. Please send your queries to Yuliia Salei at ysalei@kpmg.ua.

We look forward to seeing you at our event!