The 14th annual IFRS Forum Ukraine was held from 16–18 July 2025, coinciding with Accountant and Auditor Day.

The Forum provided a platform for leading experts in accounting, auditing, finance, tax policy and public administration to converge under the slogan “A profession that shapes the future: sustainability, development and country building”. Over the course of three days, participants engaged in discussions on the most pressing issues affecting the professional community today. These issues ranged from reforming the education system and improving the quality of training to the introduction of digital solutions, the implementation of ESG reporting standards, the adaptation of international financial reporting standards (IFRS) and new challenges in auditing practice.

Special attention was paid to the transformation of the tax system, the introduction of XBRL, the development of electronic auditing, and the impact of European integration on regulatory frameworks. Representatives of BDO in Ukraine participated actively in the event, sharing their practical experience and vision for the future of the industry. A notable feature of the forum was the "Digital Drive" segment, expertly moderated by Alla Savchenko, the President of BDO in Ukraine. This segment centred on the pivotal roles of artificial intelligence (AI), cybersecurity and automated solutions in shaping the future of accounting. Due to her considerable experience in auditing and financial reporting, the discussion was substantive and covered the key challenges and opportunities associated with the digital transformation of the profession. Alla Savchenko established the tone for the conversation and facilitated an active exchange of ideas among participants, emphasising the importance of adapting to technological changes and integrating innovation into the daily practice of professionals.

Alla Savchenko shared her thoughts on the matter: “Digitalisation is not a passing trend, it is the present. AI inspires excitement in some and fear in others. Our field is undergoing rapid modernisation, and we must move forward accordingly. It is important to understand how to work with AI so that it poses no risks and helps instead. I consider its greatest benefit to be in routine tasks.”

ESG reporting. Which to use in Ukraine: ESRS or GRI?

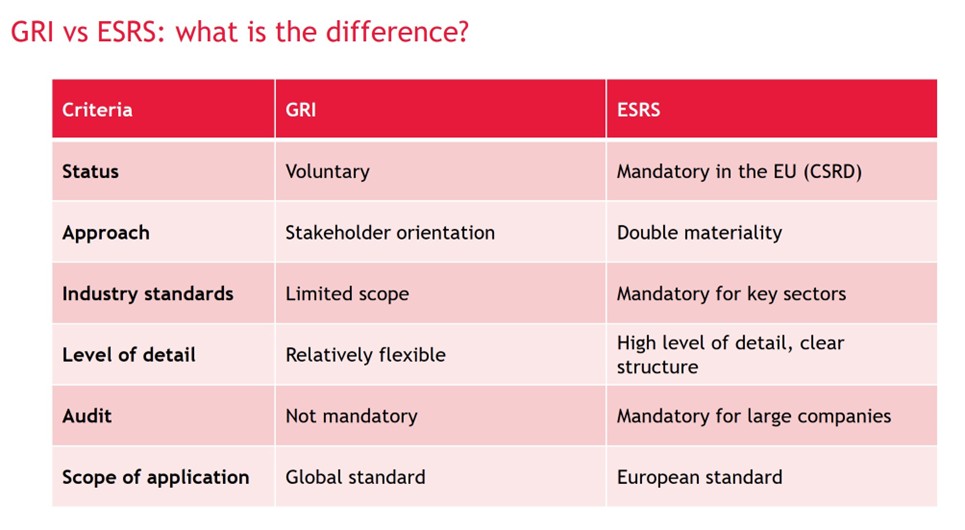

Anastasiia Skok, Head of ESG at BDO in Ukraine, explained the importance of non-financial reporting for companies, in particular its role in ensuring transparency, access to finance and strengthening reputation. Anastasiia highlighted the differences between GRI and ESRS standards, their main features and advantages for different types of businesses.

In particular, it was noted that GRI is a voluntary standard suitable for companies of all sizes and sectors, while ESRS is mandatory for large businesses in the EU and requires external auditing. The choice of standard depends on the size of the company, the market and the resources available. Accountants and auditors also play an important role in the preparation of ESG reporting, ensuring that ESG data is accounted for and that the reporting is accurate.

“The introduction of non-financial reporting is an important step for Ukrainian companies seeking to comply with international sustainable development standards. This will not only improve business transparency, but also help attract investment and increase trust among partners and customers”, said Anastasiia Skok.

Concluding her presentation, Anastasiia invited Ukrainian companies to begin implementing GRI as an initial step towards adapting non-financial reporting, and to gradually transition to ESRS with the support of external experts or consultants. She also noted that non-financial reporting is not just a trend, but a reality of the new market, which is already influencing partnerships with the EU.

The use of AI in the financial sector

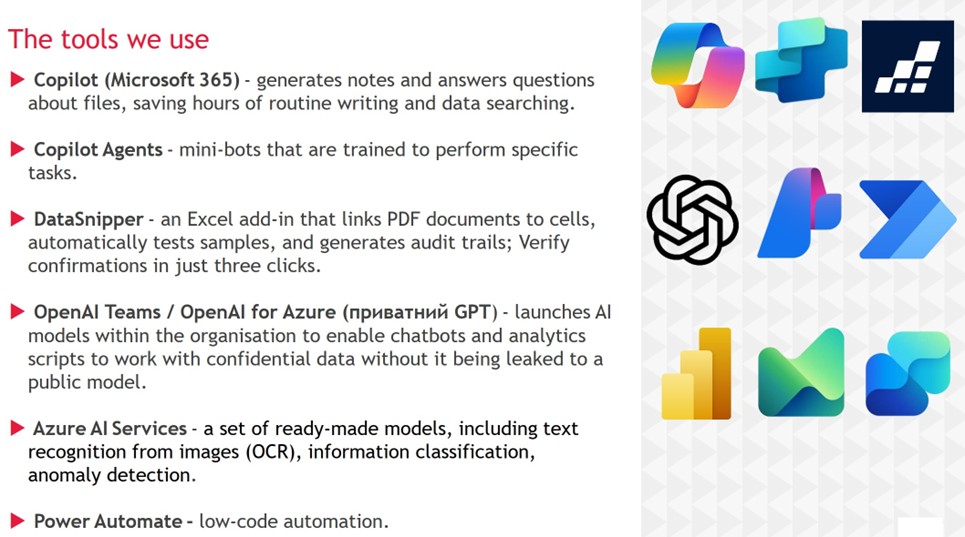

Mykhailo Atamanov, business analyst and leader of the AI industry group, delivered a presentation on the use of AI in finance. He emphasised that AI helps automate routine tasks and optimise business processes, enabling companies to improve efficiency and reduce the workload on employees.

Mykhailo also provided a detailed overview of the company’s automation and data analysis tools. These include Copilot, DataSnipper, OpenAI, and Azure AI Services. These tools assist with generating notes, automatically testing samples, launching AI models within the organisation, and reading text from images.

The financial sector is increasingly incorporating artificial intelligence, with the aim of automating routine tasks and optimising business processes. For instance, the following list sets out some of the primary AI functions:

- Document OCR: Automatic document scanning for further processing of information.

- RPA + Low-Code: Automatic execution of tasks with minimal human involvement.

- Generative AI: Generates IFRS notes, explains discrepancies, prepares comparative analysis.

- Analytics: Cash flow forecasting, anomaly detection, what-if scenarios.

- Tax & Compliance: Automatic calculation of VAT/income tax with validation.

- Expenses & AP Automation: Automatic transaction matching, expense approval with approval tools.

- Internal chatbots: Financial FAQs, the bot answers frequently asked questions.

Information security challenges

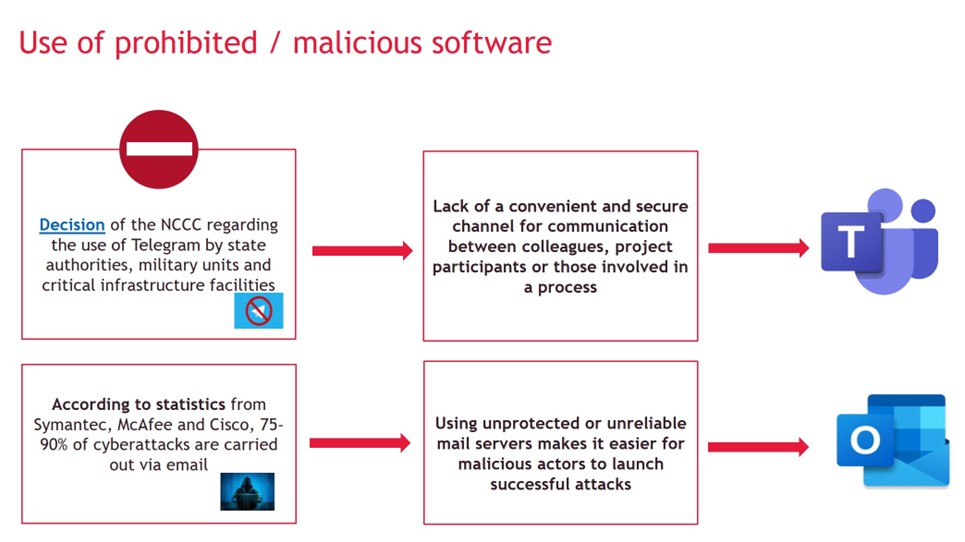

Andrii Paios, Head of IT at BDO Ukraine, presented on the key challenges and solutions in the field of cybersecurity. In his presentation, he emphasised the relevance of cybercrime and its consequences for business. Andrii also spoke about the importance of using modern security management systems and the need to implement cybersecurity policies in companies. He emphasised the significance of collaboration between different departments to ensure a comprehensive approach to information protection.

“It is important that the company’s entire ecosystem is designed in a way that makes it convenient to work in, while also ensuring sufficient protection and security. Based on our experience, we recommend using system solutions that facilitate work. Employee awareness of security issues is also, of course, a very important factor”, Andrii noted in his speech.

In conclusion, it is worth noting that the digital transformation, which was discussed at length during the forum, has long been a reality for the BDO in Ukraine team. The company is actively developing its digital services and offers a wide range of solutions, including: the use of artificial intelligence, cyber security, process automation, as well as support services for ESG reporting and sustainable development. This helps clients to confidently integrate innovation into their business processes and meet modern challenges, so contact us.